Tiger Adjusters

How do I buy my own Tiger Adjusters Franchise?

In order to buy a Tiger Adjusters franchise of your own, you will be required to have a minimum of $50,000 in liquid capital and be able to make an initial total investment of $50,000. Your investment will cover the cost of starting your own Tiger Adjusters location such as the franchise fee, marketing expenses, office equipment, licenses and permits, and training.Tiger Adjusters offers franchisees data-driven leads, a custom automated CRM, an interactive training program, sales support, marketing services, and a proprietary claims management process. Join the Fight to help property owners with their insurance claims!

About

The Problem

Since 1992, multiple lawsuits against various insurance carriers have revealed an industry-wide effort of delaying claims to deliver profits. Additionally, insurance adjusters are often incentivized to deny claims or pay as little as possible on homeowner or commercial property claims, allowing funds meant for policyholders to be retained by the insurance company.

Do you want to be paid less than it takes to repair property damage, or do you want full coverage?

The Solution

A study by the state of Florida found that homeowners who utilized a Public Adjuster as their claim advocate, on average, increased their insurance claim settlements by 747% (OPPAGA, 2010).

We are developing the first nationwide Public Adjuster Franchise dedicated to empowering an army of underrepresented Public Adjusters to bring about more settlement success stories. Our current franchises have successfully settled claims with up to 3,200% more settlement funds, allowing property damage to be fully covered by insurance companies so that repairs can take place.

Tiger Adjuster Franchise

Tiger Adjusters has built a reputable franchise brand to attract clients based on trust and recognition.

Lead Generation

We target property owners impacted by weather events. Our proprietary system combines weather, property, and contact data to deliver the best opportunities for franchisees through our in-house SaaS platform.

Marketing Support

We provide marketing support that leverages transmedia marketing tactics, franchise target market research, customized creative assets, quarterly campaign support, and personal story amplification for Google placement. Optional support includes developing a referral network for Public Adjusters.

Custom Claims CRM

Our custom claims processing workflow includes technology tools and software platforms that streamline the claims process, enhancing efficiency and improving the client experience. With this system, franchisees experience fewer issues and faster payouts while maintaining legal compliance.

Training

Franchisees receive comprehensive interactive training and ongoing education through our Certified Roar program, ensuring they are up-to-date with industry trends, technology, and regulatory changes.

Support

We offer dedicated support staff that franchisees can engage, such as Claims Estimators or Claims Inspectors, to augment their work and maximize effectiveness.

Who Do We Serve

The market for Public Adjusters includes both homeowners and commercial property owners.

Homeowner Market

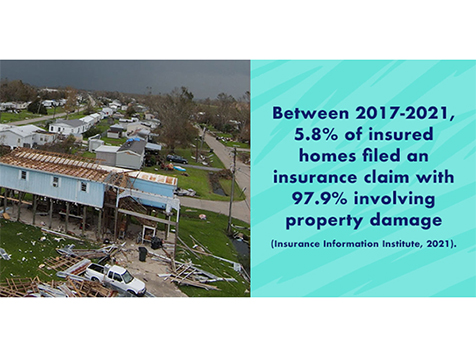

The U.S. homeownership rate as of the first quarter of 2023 is 66% (Taylor & Segal, Bankrate, 2023). From 2017-2021, 5.8% of insured homes filed an insurance claim, with 97.9% involving property damage (Insurance Information Institute, 2021).

Commercial Market

The commercial real estate market is the 5th largest industry in the United States, with approximately $16 trillion in economic impact (IBIS World, 2022). The average small business claim for fire, water, storm, and wind damage ranges between $17,000 - $35,000, with weather and fire accounting for 40% of damage claims (The Hartford, 2015).

Homeowners who have experienced property damage due to events such as fires, floods, storms, or other disasters hire Public Adjusters to help navigate the claims process. Commercial property owners and business operators use Public Adjusters when their businesses suffer damage, including business interruption claims.

Both homeowners and commercial property owners seek to maximize their compensation from insurance carriers to repair or rebuild their properties.

What is a Public Adjuster?

A Public Adjuster is a state-licensed insurance professional hired by a homeowner or commercial property owner to advocate on behalf of that policyholder with the insurance company.

Public Adjusters are trained to interpret policies, conduct damage inspections, scope and estimate losses, submit claims, and negotiate with insurance companies to secure maximum settlement amounts.

Key Services Provided by Public Adjusters

- Conducting a free property inspection to review and document damages.

- Offering a complimentary policy review with advice on the recommended course of action for a claim.

- Negotiating quickly to settle a claim in a timely manner.

- Filing the claim and handling all necessary paperwork.

- Advocating to secure a claim settlement that fully covers damages.

Contact This Company

Other Franchises Looking For Owners Like You in California

Fresh Coat

Fresh Coat is North America’s leading high-volume interior painting company. Be the boss - don’t paint! Build an organization in an industry with high income potential. Fresh Coat is a turn-key franchise offering high profit margins and low start-up…

Cash Required: $50,000

SiteSwan

Start your own web design business with SiteSwan. Create & sell websites to small businesses in your area with our easy-to-use, private label website builder. Set your own prices - keep 100% of the sales. Our turnkey platform is designed for anyone looking to…

Cash Required: $199

Automated Investments

Automated Investments is the pillar of e-Commerce automation. Automated Investments build and operate profitable and hands off Amazon FBA (Fulfilled-By-Amazon) businesses for their clients and investors. While the clients and investors act as the capital…

Cash Required: $100,000

HealthyYOU Vending

The demand for healthier food choices is exploding – don’t miss this window of opportunity! Provide in-demand healthier snacks and drinks through our state-of-the-art vending systems. Enjoy franchise-level support without the financial burden of royalties…

Cash Required: $60,000

Blue Coast Savings Consultants

Blue Coast Savings Consultants is a leading consultancy in cost savings and expense reduction. For over 30 years, our advisors have helped businesses enhance their profits and achieve greater financial flexibility by cutting unnecessary costs. If we don’t…

Cash Required: $70,000

Bath Tune-Up

Bath Tune-Up specializes in full-service bath remodels of all sizes, from quick updates to full-scale renovations. Our four core services include bathtub and shower remodels, tub-to-shower conversions, and complete bathroom remodels. Our streamlined,…

Cash Required: $74,000

Fuego Cravings

Jump into your entrepreneurial journey with a unique culinary experience that blends the traditional flavors of Mexican cuisine with the fresh and healthy ingredients that are so popular in California. Bring the flavors of California Mexican fusion to your…

Cash Required: $200,000

HomeVestors of America

Nationally recognized as the "We Buy Ugly Houses®" brand, HomeVestors® is growing. Have you recently found you want more control over your finances? Find out how you can be a franchise owner with America's #1 Home Buyer and capitalize on the…

Cash Required: $100,000

Express Employment Professionals

Express Employment Professionals is the top staffing franchise in North America. Ranked #1 by Entrepreneur Magazine for 13 consecutive years, we have more than 860 awarded locations with an average of more than $6.4 million in top-line sales for mature…